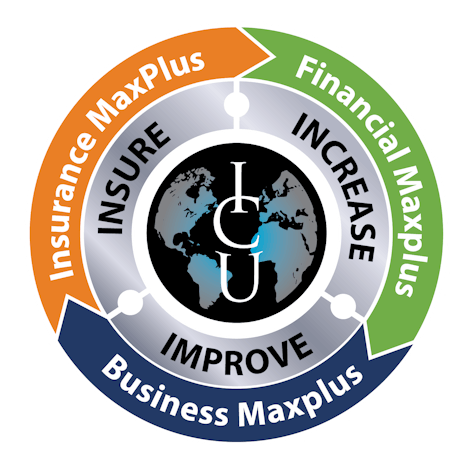

Innovative Choices Unlimited, The ICU Network is a business, financial and insurance services organization focused on improving, insuring, and increasing your net-worth. We offer advanced business solutions, innovative financial strategies and personalized insurance products and services to individuals, families and enterprises.

Innovative Choices Unlimited, The ICU Network is a business, financial and insurance services organization focused on improving, insuring, and increasing your net-worth. We offer advanced business solutions, innovative financial strategies and personalized insurance products and services to individuals, families and enterprises.

© 2020 The ICU Network. All Rights Reserved.

© 2020 The ICU Network. All Rights Reserved.

Powered by mobiigo.com

Powered by mobiigo.com

Got Any Questions?

Feel free to contact us, and one of our agents will get in touch with you within 1 business day.

Got Any Questions?

Feel free to contact us, and one of our agents will get in touch with you within 1 business day.

Call Us Today: 909-460-8290

info@theicunetwork.com

Our Office

473 E. Carnegie Drive, Suite 200

San Bernardino, CA 92408

Working Hours

Monday through Friday: 9am to 5pm

Call Us Today: 909-460-8290

info@theicunetwork.com

Our Office

473 E. Carnegie Drive, Suite 200

San Bernardino, CA 92408

Working Hours

Monday through Friday: 9am to 5pm

Our Office

473 E. Carnegie Drive, Suite 200

San Bernardino CA 92408

Working Hours

Monday through Friday: 9am to 5pm

Our Office

473 E. Carnegie Drive, Suite 200

San Bernardino CA 92408

Working Hours

Monday through Friday: 9am to 5pm

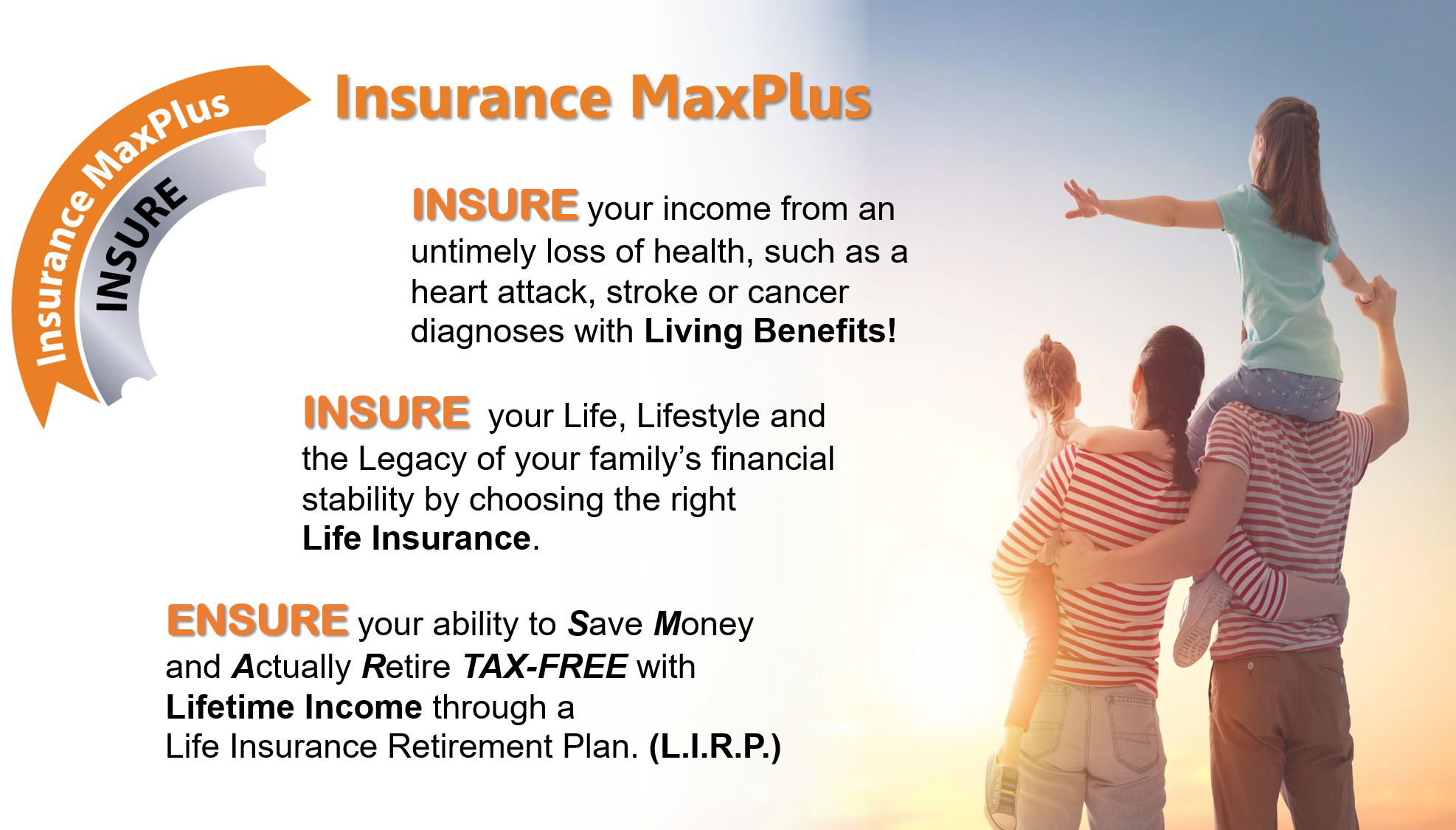

Insurance MaxPlus

Insurance MaxPlus

OUR NETWORK of certified professionals and premier providers are well aligned and committed to offering proven concepts, solution-based services, step-by-step strategies, and side-by-side support to individuals, families, and enterprises who are striving for financial independence. Helping People. Grow Financially!

OUR NETWORK of certified professionals and premier providers are well aligned and committed to offering proven concepts, solution-based services, step-by-step strategies, and side-by-side support to individuals, families, and enterprises who are striving for financial independence. Helping People. Grow Financially!

LIFE INSURANCE

Everyone needs affordable life insurance! The question for most consumers is:

Where can I find affordable life insurance?

The answer is right here at ICU, an independent nationwide wholesaler of life insurance. As an independent broker we can help consumers shop and compare all the major carriers.

LIFE INSURANCE

Everyone needs affordable life insurance! The question for most consumers is:

Where can I find affordable life insurance?

The answer is right here at ICU, an independent nationwide wholesaler of life insurance. As an independent broker we can help consumers shop and compare all the major carriers.

Insurance

Insurance

Retirement

Retirement

TAX REDUCTION

There can be many retirement strategies that can help in the reduction of taxes. Although ICU does not give tax or legal advice, we do have strategies that can help manage the impact of taxable exposure to your retirement plan.

TAX ADVANTAGE

One of the most unique strategies in the financial services industry is maximizing tax advantage vehicles that are available for you. Set up an appointment today and ask about this amazing strategy.

TAX REDUCTION

There can be many retirement strategies that can help in the reduction of taxes. Although ICU does not give tax or legal advice, we do have strategies that can help manage the impact of taxable exposure to your retirement plan.

TAX ADVANTAGE

One of the most unique strategies in the financial services industry is maximizing tax advantage vehicles that are available for you. Set up an appointment today and ask about this amazing strategy.

ANNUITIES

An annuity is a financial product typically used by investors to save tax-deferred for retirement or to generate regular income payments, helping to replace a paycheck during retirement.

Annuities are insurance contracts whose payments are guaranteed by the company issuing the contract.

There are 2 major categories: Variable annuities and Fixed annuities.

ANNUITIES

An annuity is a financial product typically used by investors to save tax-deferred for retirement or to generate regular income payments, helping to replace a paycheck during retirement.

Annuities are insurance contracts whose payments are guaranteed by the company issuing the contract.

There are 2 major categories: Variable annuities and Fixed annuities.

Annuities

Annuities

SOCIAL SECURITY

ICU sponsors many Social Security workshops that can answer the most commonly asked questions.

- How do the new Social Security laws affect my retirement strategy?

- When is the best time to collect my Social Security benefits?

- What happens if my spouse is still working?

- How do I avoid the 85% tax if I earn over $16,000 while retired?

- What if I still want to work part-time?

- What if I am divorced or widowed?

- How can I maximize my Social Security benefits?

- How can I reduce taxes on Social Security?

SOCIAL SECURITY

ICU sponsors many Social Security workshops that can answer the most commonly asked questions.

- How do the new Social Security laws affect my retirement strategy?

- When is the best time to collect my Social Security benefits?

- What happens if my spouse is still working?

- How do I avoid the 85% tax if I earn over $16,000 while retired?

- What if I still want to work part-time?

- What if I am divorced or widowed?

- How can I maximize my Social Security benefits?

- How can I reduce taxes on Social Security?

Social Security

Social Security

Innovative Choices Unlimited Network

Innovative Choices Unlimited Network

Welcome to

Welcome to

Living Benefits

Living Benefits

Business Formation

Business Formation

Debt Elimination

Debt Elimination

Life Insurance

Life Insurance

Lifetime Income

Lifetime Income

Business Credit

Business Credit

Business Financing

Business Financing

Wealth Creation

Wealth Creation

Estate Preservation

Estate Preservation

By utilizing our blueprint, the Wealth-P.L.A.N., together we can help you gain more financial freedom OPTIONS. We’ll work side by side and show you step-by-step,

how to Prepare for growth,

what to Leverage for growth,

where to Acquire your growth,

when to Navigate your growth.

Having a $.M.A.R.T. plan to Save Money and Actually Retire TAX-FREE

will allow you to be S.U.R.E. you can grow a Safe Useable Revenue to Enjoy!

By utilizing our blueprint, the Wealth-P.L.A.N., together we can help you gain more financial freedom OPTIONS. We’ll work side by side and show you step-by-step,

how to Prepare for growth,

what to Leverage for growth,

where to Acquire your growth,

when to Navigate your growth.

Having a $.M.A.R.T. plan to Save Money and Actually Retire TAX-FREE

will allow you to be S.U.R.E. you can grow a Safe Useable Revenue to Enjoy!

Creating Your Wealth Blueprint

Creating Your Wealth Blueprint

IMPROVE your company’s LEVERAGE-ability by choosing the right

Business Formation for banking and borrowing a better way.

IMPROVE your company’s LEVERAGE-ability by choosing the right

Business Formation for banking and borrowing a better way.

IMPROVE your company’s ACCESS-ability to Business Financing by utilizing our

step-by-step process to obtain working capital.

IMPROVE your company’s ACCESS-ability to Business Financing by utilizing our

step-by-step process to obtain working capital.

IMPROVE your company’s FUND-ability by optimizing your Business Credit, Credibility, and Capital.

IMPROVE your company’s FUND-ability by optimizing your Business Credit, Credibility, and Capital.

INCREASE your financial EQUITY

by utilizing your good debt to eliminate

your bad debt in as little as 7 to 12 years.

INCREASE your financial EQUITY

by utilizing your good debt to eliminate

your bad debt in as little as 7 to 12 years.

INSURE your income capability from an untimely illness such as a heart attack,

stroke, or cancer with Living Benefits!

INSURE your income capability from an untimely illness such as a heart attack,

stroke, or cancer with Living Benefits!

INCREASE your potential for WEALTH

by leveraging your home’s equity to fund

your Real Estate investments, Business

Ventures and/or Retirement Planning.

INCREASE your potential for WEALTH

by leveraging your home’s equity to fund

your Real Estate investments, Business

Ventures and/or Retirement Planning.

INSURE what matters most

by choosing the right Life Insurance

to protect your family’s financial stability.

INSURE what matters most

by choosing the right Life Insurance

to protect your family’s financial stability.

Get my quote

Get my quote

Wealth Creation

Overview

Wealth Creation

Overview

FREE consultation

FREE consultation

APPLY now

APPLY now

Debt Elimination

Overview

Debt Elimination

Overview

Check my plan

Check my plan

Creating Legacy's

One Family at a Time

Creating Legacy's

One Family at a Time

Business MaxPlus

Business MaxPlus

INSURE your income capability from an untimely illness such as a heart attack, stroke, or cancer with

Living Benefits!

INSURE your income capability from an untimely illness such as a heart attack, stroke, or cancer with

Living Benefits!

INSURE what matters most by choosing the right Life Insurance

to protect your family’s financial stability.

INSURE what matters most by choosing the right Life Insurance

to protect your family’s financial stability.

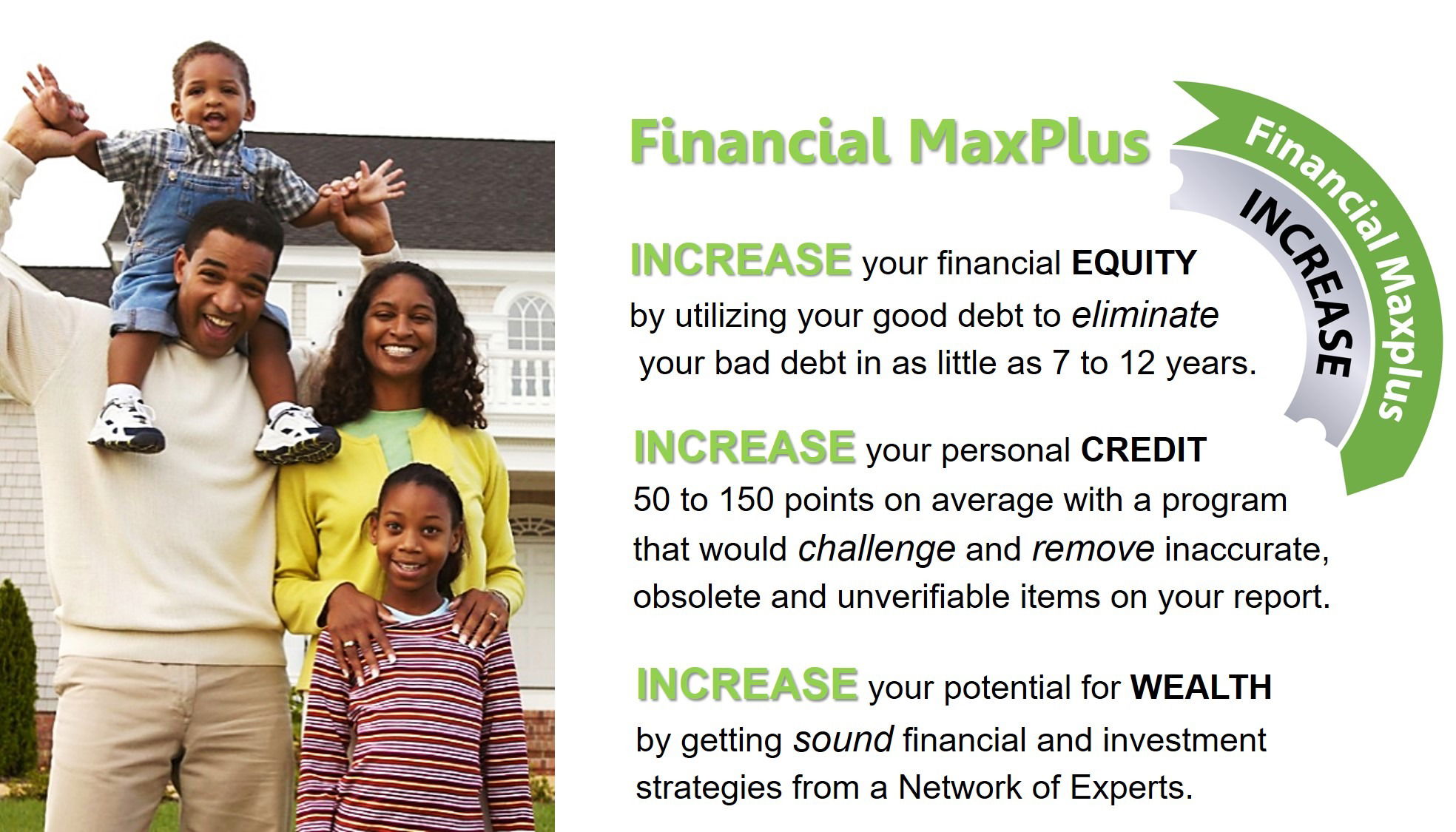

Financial MaxPlus

Financial MaxPlus

INCREASE your financial EQUITY

by utilizing your good debt to eliminate your bad debt in as little as 7 to 12 years.

INCREASE your financial EQUITY

by utilizing your good debt to eliminate your bad debt in as little as 7 to 12 years.

INCREASE your potential for WEALTH by leveraging your home’s equity to fund your Real Estate investments, Business Ventures and/or Retirement Planning.

INCREASE your potential for WEALTH by leveraging your home’s equity to fund your Real Estate investments, Business Ventures and/or Retirement Planning.